Trump’s April 2025 reciprocal tariff speech sparks global economic jitters. Here’s how it’s shaking up the crypto markets—from mining to inflation fears.

🏛️ What Did Trump Just Announce?

On April 2, 2025, former President Donald Trump returned to the spotlight with a fiery speech from the White House Rose Garden. He called it “Liberation Day”—the beginning of a new era for U.S. trade policy.

Here’s what he dropped:

- A baseline 10% tariff on all imports 🚢

- Higher reciprocal tariffs on 47+ countries, targeting those with major trade surpluses 📊

- China: 34%, Vietnam: 46%, India: 26%, and more (full list below)

Trump’s reasoning? “Fair trade, not free trade.” He emphasized protecting U.S. sovereignty, economic security, and industry.

🧠 Quote from the speech:

“We are not going to be the piggy bank of the world anymore.” — Donald J. Trump

💹 Immediate Market Reaction

Trump’s tariff bombshell spooked investors across the board. Here’s how markets responded:

| Asset | Before Tariffs | After Tariffs | Change |

|---|---|---|---|

| Bitcoin (BTC) | $88,398 (high) | $83,777 (current) | ↓ ~5.2% |

| Ethereum (ETH) | $1,943 (high) | $1,827 (current) | ↓ ~6.0% |

| Coinbase (COIN) | $187.13 (high) | $182.95 (close) | ↓ ~2.2% |

🔍 Note: Prices reflect intraday highs vs. latest market levels on April 3, 2025.

🔧 How Tariffs Could Hit Crypto

Let’s unpack the crypto-specific implications:

🧾 1. Mining Costs Are Going Up

Many crypto mining rigs come from China, Taiwan, and Malaysia—now hit with steep reciprocal tariffs (32–46%). Expect:

- Higher equipment prices 💸

- Longer ROI for miners ⏳

- Possible mining slowdowns, especially in the U.S.

🌍 2. Global Trade Tensions = Market Volatility

Crypto often thrives in uncertainty—but not all kinds. Rising tariffs could:

- Weaken global liquidity

- Trigger inflation

- Pressure stablecoins tied to USD-based economies

🏦 3. Flight to Alternative Assets?

Some investors might see Bitcoin as a hedge if inflation rises. So while there’s short-term fear, long-term holders may benefit.

📊 Full List: Countries Hit With New U.S. Reciprocal Tariffs

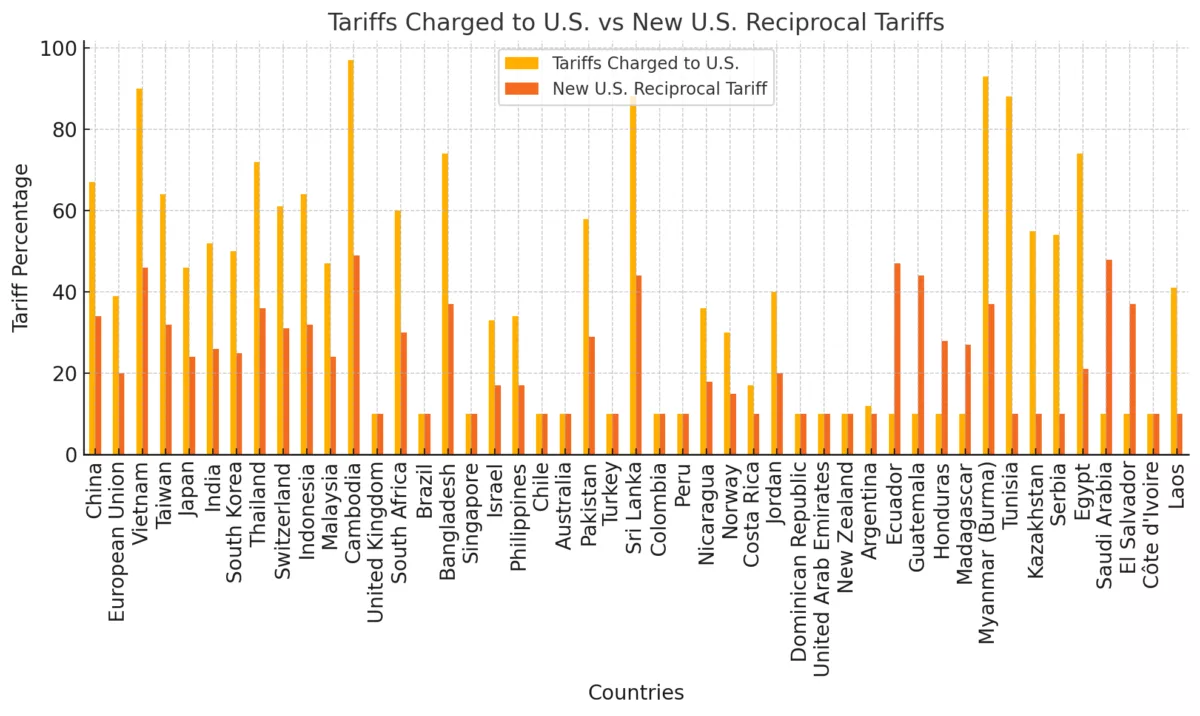

Here’s the full breakdown of countries hit with Trump’s new reciprocal tariffs in 2025. The U.S. is responding to decades of imbalanced trade by matching (or partially matching) the tariffs imposed by other countries. As you’ll see, nations like Vietnam, Cambodia, and China face some of the steepest reciprocal tariffs—ranging from 34% to 49%. These changes are expected to shake up global supply chains and could increase costs for industries that rely on imports—including crypto mining.

| Country | Tariffs Charged to U.S. | New U.S. Reciprocal Tariff |

|---|---|---|

| China | 67% | 34% |

| European Union | 39% | 20% |

| Vietnam | 90% | 46% |

| Taiwan | 64% | 32% |

| Japan | 46% | 24% |

| India | 52% | 26% |

| South Korea | 50% | 25% |

| Thailand | 72% | 36% |

| Switzerland | 61% | 31% |

| Indonesia | 64% | 32% |

| Malaysia | 47% | 24% |

| Cambodia | 97% | 49% |

| United Kingdom | 10% | 10% |

| South Africa | 60% | 30% |

| Brazil | 10% | 10% |

| Bangladesh | 74% | 37% |

| Singapore | 10% | 10% |

| Israel | 33% | 17% |

| Philippines | 34% | 17% |

| Chile | 10% | 10% |

| Australia | 10% | 10% |

| Pakistan | 58% | 29% |

| Turkey | 10% | 10% |

| Sri Lanka | 88% | 44% |

| Colombia | 10% | 10% |

| Peru | 10% | 10% |

| Nicaragua | 36% | 18% |

| Norway | 30% | 15% |

| Costa Rica | 17% | 10% |

| Jordan | 40% | 20% |

| Dominican Republic | 10% | 10% |

| United Arab Emirates | 10% | 10% |

| New Zealand | 20% | 10% |

| Argentina | 10% | 10% |

| Ecuador | 12% | 10% |

| Guatemala | 10% | 10% |

| Honduras | 10% | 10% |

| Madagascar | 93% | 47% |

| Myanmar (Burma) | 88% | 44% |

| Tunisia | 55% | 28% |

| Kazakhstan | 54% | 27% |

| Serbia | 74% | 37% |

| Egypt | 10% | 10% |

| Saudi Arabia | 10% | 10% |

| El Salvador | 10% | 10% |

| Côte d’Ivoire | 41% | 21% |

| Laos | 95% | 48% |

| Botswana | 74% | 37% |

| Trinidad and Tobago | 12% | 10% |

| Morocco | 10% | 10% |

Visualizing the Disparity: This chart shows the difference between the tariffs charged to the U.S. and the new reciprocal tariffs imposed by Trump in 2025. The goal? To “level the playing field.” For crypto, this chart matters because many affected countries export mining equipment, chips, and tech components. That means higher costs for miners and possibly reduced profitability for U.S.-based operations.

🤔 What Should Crypto Investors Do?

✅ Watch inflation data closely

✅ Keep an eye on mining hardware markets

✅ Diversify—don’t go all in on one sector

✅ Stay informed, not scared

This tariff move may just be the beginning of a broader economic shift. Smart investors will stay ahead of the curve.

🔮 Final Thoughts

Trump’s tariff move isn’t just about trade—it’s about rewriting global economic rules. And like every macro event, it has ripple effects on crypto. The short-term volatility could hurt, but long-term? It may solidify Bitcoin’s role as a borderless hedge.

⚠️ Disclaimer

This is not financial advice (NFA). Please do your own research (DYOR) before making investment decisions.

Stay Ahead of the Crypto x Geopolitics Curve

Want real-time updates on how global policies—like Trump’s tariffs—impact your crypto portfolio?

👉 Follow us for expert breakdowns, news alerts, and market insights:

- 🐦 X (Twitter): @officialBCTreat

- 📺 YouTube: Blockchain Treat

- 💬 Telegram: Join the community

- 📘 Facebook: Blockchain Treat Page

No hype. Just solid crypto content with a dose of macro insights. 💥